Like any other industry, innovation can help restaurants get ahead by setting themselves apart from the competition.

And with countless new technologies entering the space, in addition to consumers’ increasing focus on sustainability and constant appetite for new offerings and experiences, there are many opportunities for restaurateurs to consider.

Let’s take a deeper dive into the numbers.

Restaurant Technology Trends

For the most part, consumers still generally prefer a traditional, tech-free dining experience over one that involves more digital innovations.

However, depending on the technology—and the demographics in question—some consumers may be open to newer approaches.

Restaurant Technology Preferences

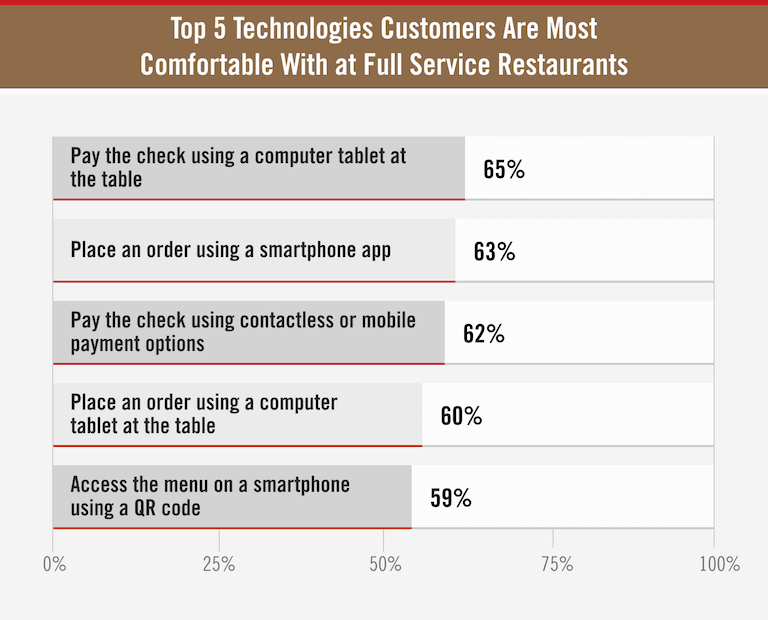

Some tech options have already become the preferred choice for a clear majority of customers, according to data from the National Restaurant Association (NRA).

65% of full service restaurant customers would likely use a tablet at the table to pay their check; slightly fewer—60%—said they would use it to place their order.

Diners seem to be a bit cooler on QR codes; while 59% said they would use a QR code to pull up a menu, fewer than half would use a QR code to pay their check (46%) or place an order (48%).

(source)

What Kind of Technology Do Customers Really Want?

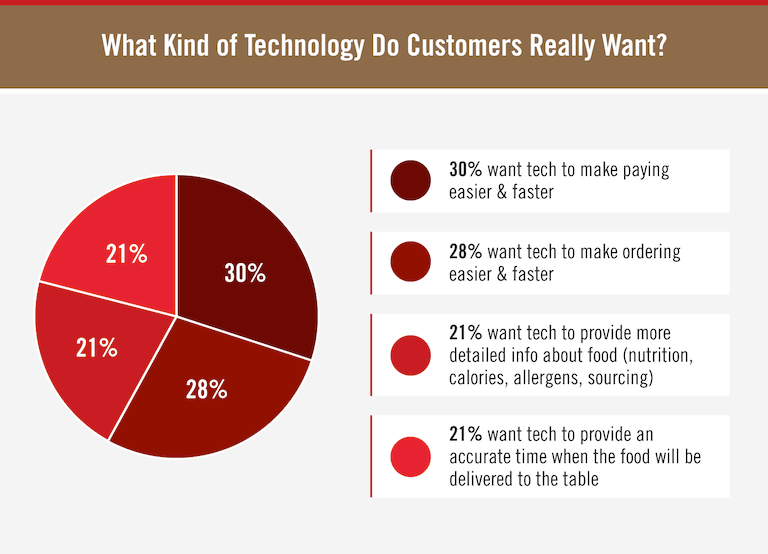

It’s worth remembering, though, that technology isn’t an end in itself—ideally, restaurateurs would choose tech options that would improve the experience of dining out. So, what kind of technology do restaurant customers want?

Presented with the following four options for their top preference for how tech should be applied at full service restaurants…

- 30% want tech to make paying easier & faster

- 28% want tech to make ordering easier & faster

- 21% want tech to provide more detailed info about food (nutrition, calories, allergens, sourcing)

- 21% want tech to provide an accurate time when the food will be delivered to the table

These results seem to imply that consumers are most interested in tech advances that make their experience more efficient—which could be a helpful perspective for restaurateurs to keep in mind when deciding how to incorporate new technologies into their businesses.

Technology Preferences by Generation

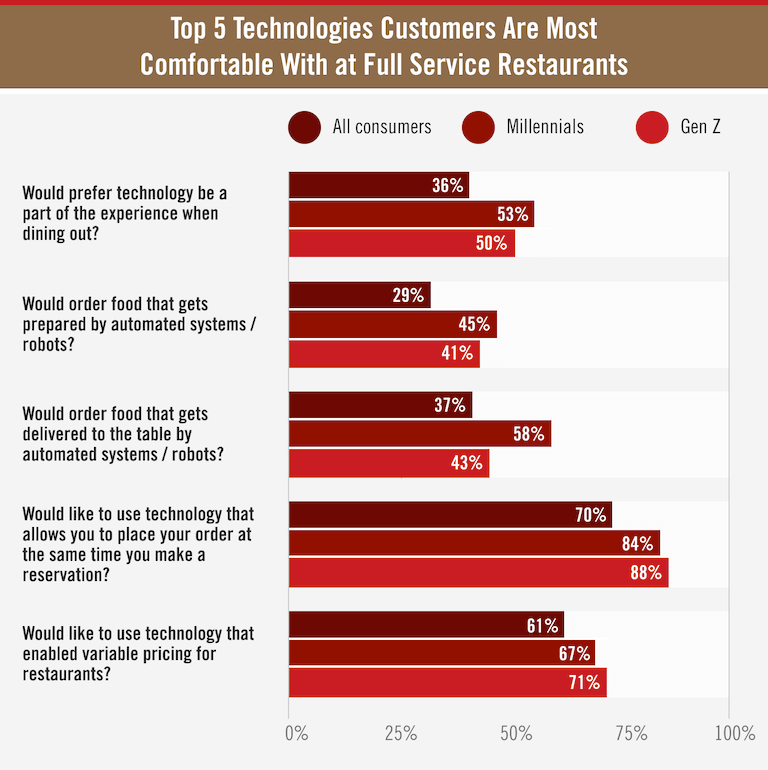

There appears to be a generation gap when it comes to technology in restaurants, with Millennials and Gen Zers much more likely to embrace innovations than Baby Boomers or Gen Xers.

For example, while most consumers still prefer a traditional dining experience to a tech-enabled one (64% to 36%), a majority of Millennials (53%) and half of Gen Zers preferred tech when dining.

29% of adults dining at a full service restaurant would order food that gets prepared by automated systems / robots, while 37% would order food that gets delivered by automated systems / robots. Millennials (45% and 58%, respectively) were most on board, followed by Gen Zers (41% and 43%).

And 61% of consumers—including 71% of Gen Zers and 67% of Millennials—would use tech that enabled variable pricing, where menu prices change depending on the day or time of day.

(source)

Restaurant Tech Investments

What kind of technologies are restaurants focusing on incorporating into their operations?

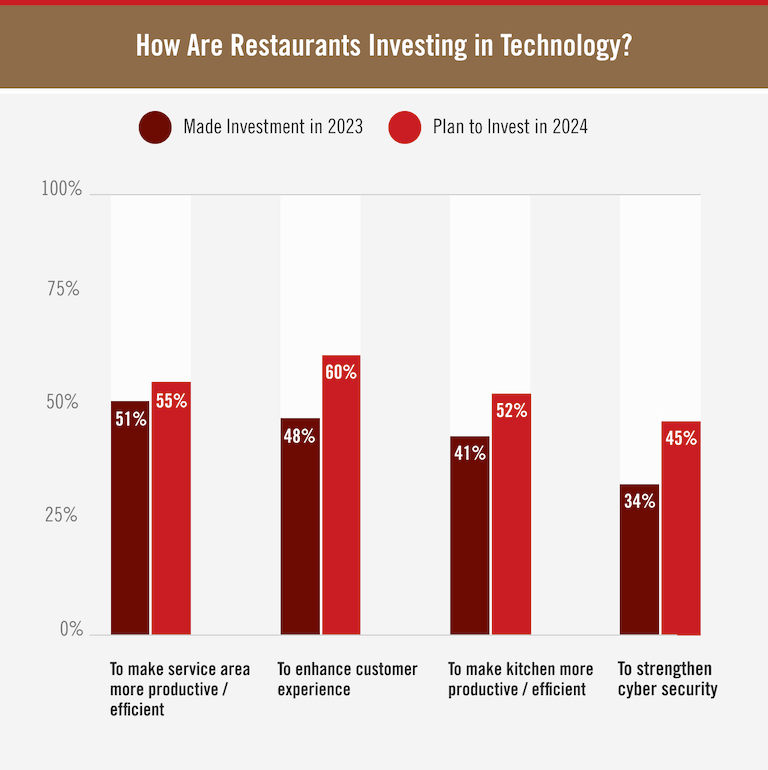

In 2023, restaurants’ highest priority was making the service area more productive or efficient, by doing things like upgrading POS or table management systems, or installing self-ordering kiosks; 51% of restaurants made investments here, and 55% planned to do so in 2024.

The second-highest priority in 2023 was enhancing the customer experience, by doing things like introducing digital menus, online reservation systems, or new tech-enabled loyalty programs. 48% of restaurants invested in this type of technology in 2023; in 2024, however, this was projected to become restaurants’ top priority, with 60% of restaurants planning to make investments here.

(source)

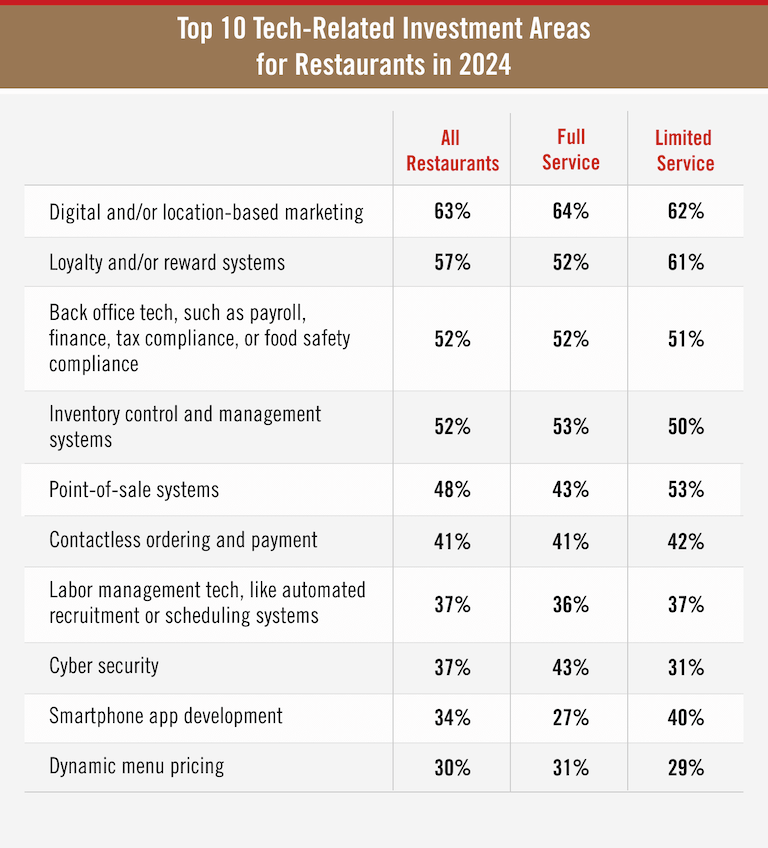

So much for the broad categories where restaurants are planning to make investments—what about the specific applications or areas restaurants are looking to invest in? The same NRA data reveals some answers—and draws some distinctions between the needs of different types of restaurants.

The data distinguishes between two types of restaurants—full service (that is, traditional sit-down restaurants with table service), and limited service (where customers order and pay, often at a counter, before receiving their food).

63% of restaurants planned to devote resources to digital and/or location-based marketing in 2024, the most out of any tech-related area. Full service and limited service restaurants gave similar responses (64% and 62%, respectively), indicating that all restaurants are putting a premium on new opportunities to grow their brand and attract customers.

40% of limited service restaurants planned to devote resources to developing a smartphone app in 2024, compared to only 27% of full service restaurants; limited service restaurants are already designed for convenience, and this data could indicate that they’re doubling down on technologies that could enhance that convenience factor.

On the flipside, 43% of full service restaurants plan to invest in cyber security in 2024, compared to only 31% of limited service restaurants. This could indicate that full service restaurants are taking new cyber threats more seriously; at the same time, it’s possible that limited service restaurants—a category that includes corporate chains like McDonald’s, Starbucks, and Domino’s—have already made cyber security investments, and full service restaurants are playing catch-up.

(source)

Wondering about the human impact of all this tech investment? 47% of restaurant owners said that in 2024, the use of technology and/or automation to help with labor shortages will become more common—meaning technology could provide some much needed relief for an ongoing staffing shortage across the industry. However, a clear majority of restaurant owners (69%) predicted that technology integration will augment rather than replace human labor.

People May Tip More When Paying Digitally

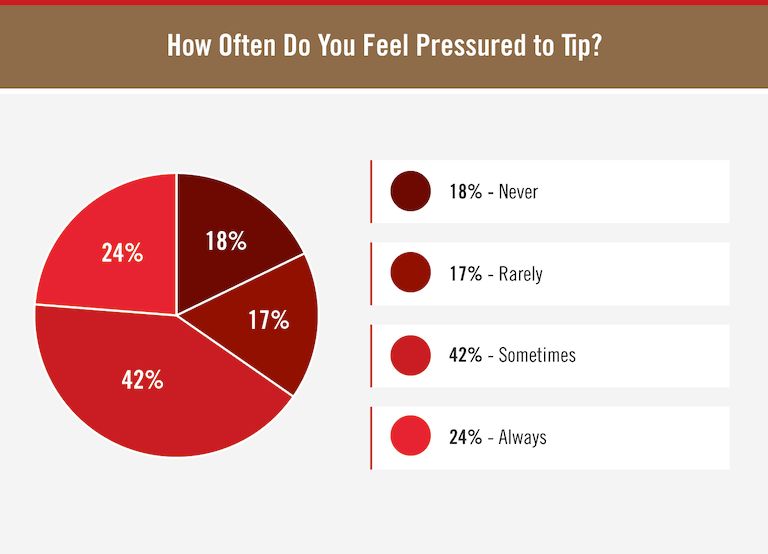

It remains to be seen what effect all this new technology will ultimately have on the dining experience; however, there’s one area where a change already seems to be underway—tipping.

As digital payment methods become more common, customers’ tipping habits seem to be shifting. According to a survey conducted by LendingTree, 60% of Americans said they were tipping more as technology makes it easier to pay (and tip).

A recent Forbes report seems to corroborate this finding; the report indicated that, when tipping digitally, almost two in three Americans (64%) will leave a tip that’s more than 10% higher than they would have left if paying with cash. And, on average, Americans’ tips were 15% higher when tipping digitally.

Innovative Restaurant Programs

It’s worth noting that innovation is not all about technology; there are a variety of programs and strategies restaurants can potentially use to appeal to customers.

Restaurant Sustainability Practices

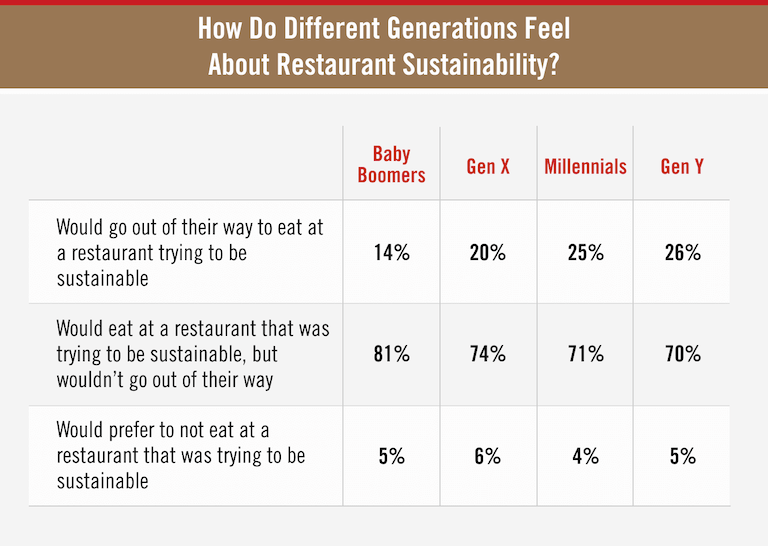

A restaurant’s sustainability practices—or lack thereof—may be increasingly important for customers when deciding where to dine.

21% of consumers would go out of their way to eat at a restaurant that was trying to incorporate sustainable practices; Millennials and Gen Zers were most likely to go out of their way to do so, with 25% of each generation saying they would.

(source)

Sustainability: Customer Priorities vs. Restaurant Practices

When it comes to sustainable practices, customers are clear about their priorities—and would even be willing to pay more to eat at a restaurant that can offer them. But are restaurants giving customers what they want?

- Customers say these are the top 5 things that would make them willing to pay more to eat at a restaurant…

- Donating excess food to charity (31%)

- On-site garden (25%)

- Zero-waste (24%)

- Local ingredients (23%)

- Reusable containers for returned food (23%)

- … while these are the top 5 most common things restaurants say they are already doing to be sustainable:

- Only give utensils/paper products with takeout by request (64%)

- Only include condiments with takeout by request (62%)

- Recycling (57%)

- Takeout in paper instead of plastic bags (55%)

- Eco-friendly cleaning products (50%)

These results seem to indicate that restaurants have prioritized low-hanging opportunities that involve swapping products for more sustainable alternatives (or simply using fewer of them). They are much less likely to be doing some of the things that topped customers’ lists—for example, only 37% are already donating food to charity, 17% maintain an on-site garden, and 11% run a zero-waste operation.

This disconnect between customer priorities and current offerings could mean restaurants that prioritize the things customers want might have an opportunity to differentiate themselves from their competitors.

(source)

Loyalty Programs

Loyalty programs are another innovative area where restaurants may be able to get an edge.

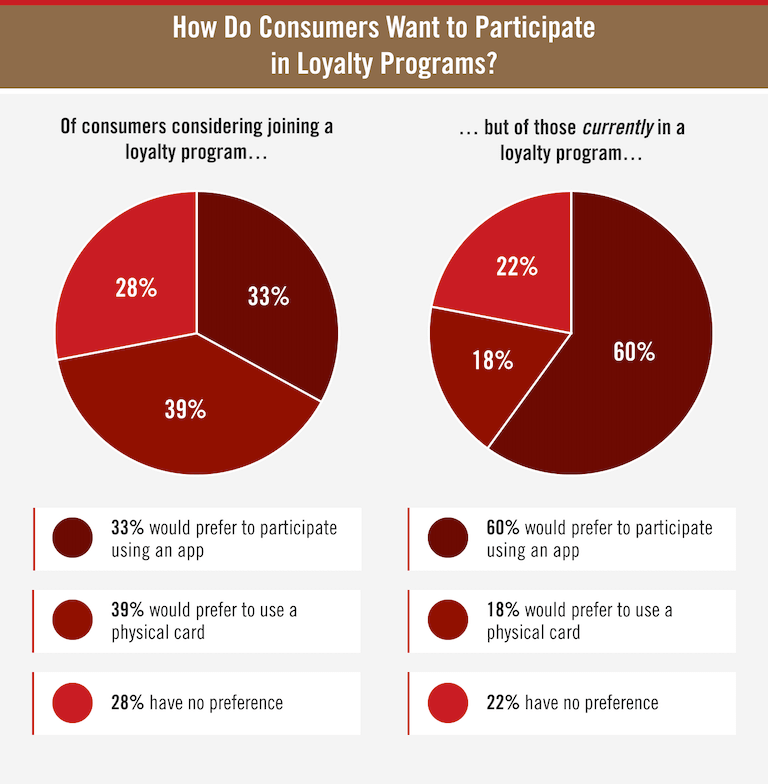

52% of consumers currently participate in a restaurant loyalty or reward program, while 81% said that they’d be interested in joining one if it was offered. Interest runs even higher with Millennials and Gen Z adults, with 87% of both groups expressing interest.

These results seem to suggest that, when it comes to attracting new loyalty program members, it may not matter whether a restaurant uses an app or a physical card; but for retaining members, an app may be more effective.

Diversifying Restaurant Offerings

Restaurants might also have opportunities to attract new business by diversifying their offerings.

Consumers expressed significant interest in a variety of unique on-site offerings—with tasting events coming in as the clear favorite, with 69% of consumers saying they’d likely participate in one.

- Top 4 opportunities for unique on-site offerings:

- 69% of consumers said they’d likely participate in a tasting event

- 52% of consumers said they’d likely participate in a private dinner with the chef / a culinary expert

- 47% of consumers said they’d likely participate in cooking classes at a restaurant

- 41% of consumers said they’d likely participate in cooking demos for kids

Off-site offerings may be even more compelling, with clear majorities of consumers expressing interest in several different ideas.

- Top 4 opportunities for unique off-site offerings:

- 73% of consumers said they’d likely order a multi-course meal bundle for takeout / delivery

- 73% of consumers said they’d likely order a meal kit of raw ingredients to cook themselves

- 67% of consumers said they’d likely participate in a meal subscription program

- 63% of consumers said they’d likely purchase fresh ingredients from a restaurant

Taken together, these results suggest that the role of a restaurant is clearly changing. No longer is it just a place to go to have a meal—instead, it can be a kind of hub for engaging with the community in a variety of different ways.

(source)

Menu Trends & Changing Preferences

Restaurateurs looking to bolster their businesses may also want to explore changing up their menus to appeal to contemporary trends and changing preferences.

Top Menu Trends

In 2024, a variety of new trends emerged that shaped menus across the country.

Top 10 Menu Trends for 2024

- World Stage Soups & Stews (like Birria, Chicken Tom Kha, Laksa, Salmorejo, Upscale Ramen)

- Global Chicken Wings

- International BBQ

- Incorporating Social Media Trends (like TikTok and Instagram)

- Grilled/Cooked Cheeses (like Provoleta, Queso Fundido, Raclette, Halloumi, Juustoleipa)

- Wagyu Beef

- Stuffed Vegetables (like Chiles en Nogada, Stuffed Peppers, Stuffed Cabbage Rolls)

- Regional Menus

- Streamlined Menus

- Hot Honey Breakfast Sandwiches

(source)

Changing Menu Offerings

But while trends come and go, how are restaurants across the industry changing their menus?

Nearly 7 in 10 (68%) of all restaurant operators said they planned to keep the size of their menus about the same in 2024 as in 2023; only 12% planned to offer more items, while 20% planned to shrink their menus.

Full service restaurants were much more likely than limited service restaurants to say they planned to offer a smaller menu, with nearly a quarter (24%) saying they would do so; only 16% of limited service restaurants said the same. This may suggest that full service restaurants are feeling the pinch of inflation more than their limited service peers, and are cutting their menus to save on food costs.

At the same time, 86% of customers said they like menus with many options—suggesting that restaurants may have to be careful when cutting down their menus, so as not to alienate customers.

(source)

Top Menu Considerations for Restaurant Owners

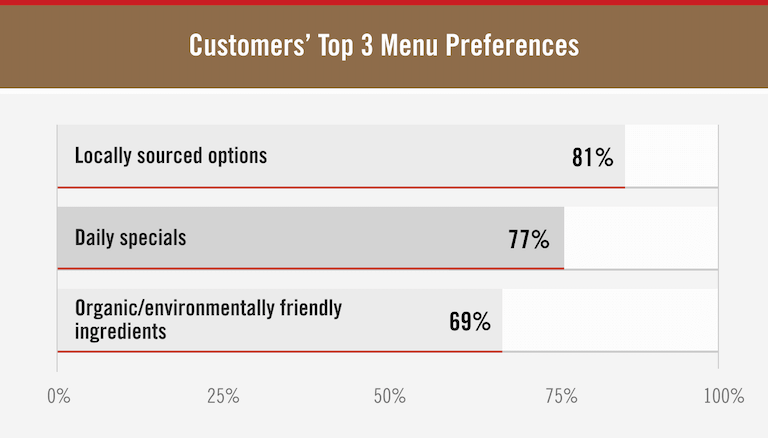

Restaurant operators who are looking to make changes to their menus would do well to take customer priorities and preferences into account. And, according to the NRA, customers have made their preferences clear.

Topping the list: 81% of customers said they’d likely order locally sourced options if available, while 77% of customers said they want to order daily specials that aren’t on the menu, and 69% of customers said they’d likely order options that included ingredients grown or raised in an organic or environmentally friendly way.

(source)

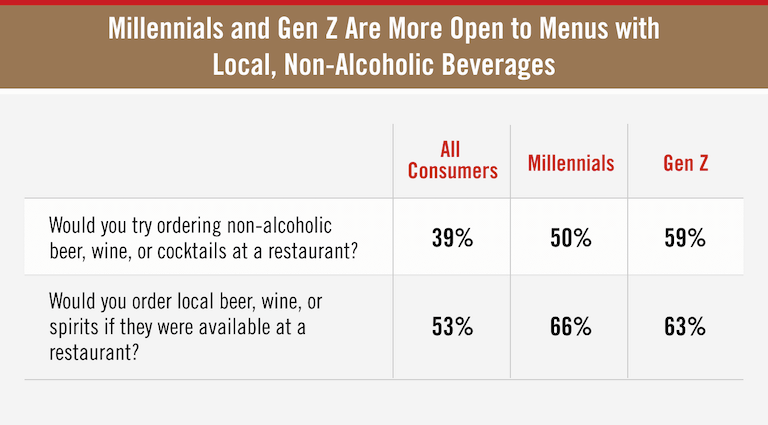

There also may be some opportunities to attract consumers—especially in the younger generations—with niche beverage offerings.

39% of adults said they’d try ordering non-alcoholic beer, wine, or cocktails; however, those numbers are significantly higher for Millennials (50%) and Gen Zers (59%).

The same pattern holds true for local beer, wine, or spirits; 53% of diners over 21 years old said they’d pick these offerings if they were available, including 66% of Millennials and 63% of Gen Zers.

(source)