Listen to This Article:

How many of us spend years honing our craft and positioning ourselves for career or business success, yet fail to educate ourselves on the one thing that can potentially alleviate the majority of stress in our daily lives: what to do with the money we earn?

Financial literacy isn’t a skill reserved for investment bankers and billionaires; it’s key for everyone—including culinary school students.

Good money management skills can help you better navigate the student loan process, budget for school expenses, and develop a plan for the future. You can also evaluate the financial prospects of a career decision to ensure it helps you meet your financial goals as well as your personal and career ones.

Financial literacy might seem formidable at first but fear not—a little information can go a long way. Don’t know where to start? Read on.

What it Means to be Financially Literate

Federal Student Aid (FSA), an office within the federal Department of Education, offers a good working definition of what financial literacy is and why it matters to students.

“Financial literacy refers to the understanding that includes how to earn, manage, and invest money and has a critical impact on students’ ability to make smart choices,” according to FSA. “Possessing the skills and information about which institution (sic) of higher education to attend, what to study, how to pay for college, and how to manage student loan debt can help students to build their financial futures.”

The Organization for Economic Cooperation and Development (OECD) calls financial literacy a “core life skill.” Yet despite its importance, only about half of Americans are financially literate, according to the World Economic Forum.

But there’s good news: you don’t need to be a wiz with numbers or obsessed with the stock market to expand upon your skill set and gain knowledge that can potentially help you make better financial decisions.

A basic financial understanding can help you plan for culinary school and your future.

Strategies to Manage Your Money

As with all financial matters, each person’s situation is unique. Make sure to do your due diligence and even consider contacting a financial advisor.*

But there are some general guidelines and rules of thumb that can potentially help you build a good foundation and grow from there. Consider these strategies when developing your own plan.*

*Auguste Escoffier School of Culinary Arts does not provide financial advice. Always consult with a professional to determine what is best for your situation.

Start With a Basic Budget

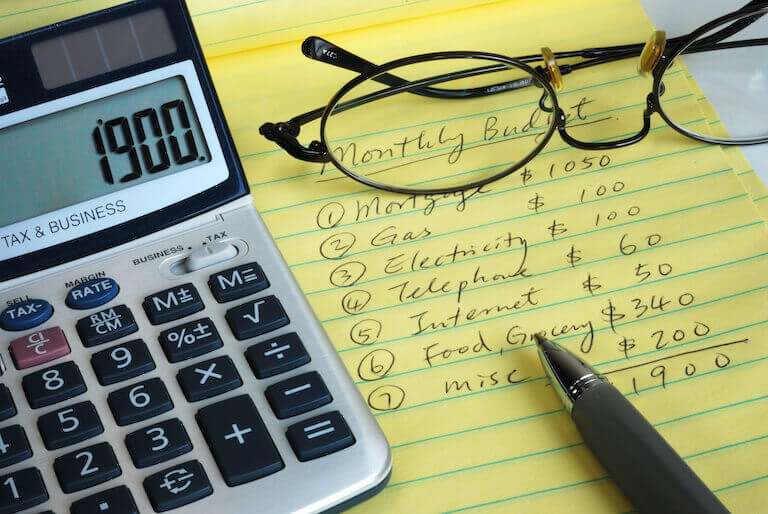

All money management strategies start with a budget. It’s important to keep track of money in and money out so you can develop healthy spending habits.

When you understand how to create a personal budget, you can give yourself some peace of mind and free up your energy to focus on other things (like culinary school!).

Your budget begins with a full accounting of all of your sources of income as well as your expenses. These include fixed and variable expenses; fixed expenses are those that remain the same each month, like rent or mortgage and car loans, while variable expenses change in cost, like groceries, entertainment, and utilities.

It can be tricky to budget for variable expenses, but you can usually figure out the fluctuations and get an average to help figure it out. A lot of variable expenses tend to fall into wants vs needs, so you’ve got some control there as well.

Consider the 50/30/20 rule when you approach budgeting: allocate 50% of your take-home pay (net income) to needs, 30% to wants, and 20% to savings, investments, and debt paydown.

This isn’t a hard-and-fast rule and can be tweaked according to your situation, but it’s a good place to start. Needs include things like rent or mortgage, car, groceries, and utilities. Wants can be things like eating out, clothing, gym memberships, and hobbies. And the third category can cover things like retirement plans, an emergency fund, student loan payments

As you explore what works best for you, consider checking out these budgeting apps to keep you on track: You Need A Budget (YNAB), Goodbudget, Pocket Guard, EveryDollar, and Monarch Money.

A personal budget can help you stay on track with your financial goals.

Pay Yourself First: Build Your Savings

One of the biggest “rules” in budgeting says to pay yourself first. Many of us tend to do the opposite, calculating rent, car, and everything else before looking at what we can save.

Consider tackling that 20% first in the 50/30/20 rule and making your savings and investments the priority. After those are taken care of, you’d then look at what you’d ideally pay for rent or mortgage, car, entertainment, etc.

Even if you don’t think you can set aside a full 20% of your take-home pay, try to set aside some savings consistently. Small amounts can add up.

Investing 101

Investing can be for everyone. Aside from whether you decide to invest on your own, remember too that a 401(k) is a package of investments. If your employer offers one, it’s in your best interest to know everything you can about it and how it works.

Like budgeting and other financial concepts, a handful of basic investment concepts can get you set you on a good path. Investing is all about remembering the power of compound interest; again, even a little at a time can add up if you remain consistent.

Here are some common terms to know:*

- Stocks—shares in a publicly traded company. If you own stocks, you own a fraction of that company.

- Bonds—a type of loan to a company or government in which a group of lenders pool their money and earn interest; by investing in or purchasing bonds, you can be one of the lenders in that pool and earn interest on your money.

- Mutual Funds—a portfolio of investments in which investors’ funds are pooled to purchase stocks, bonds, short-term debt, and the like.

- ETF—stands for exchange-traded fund, a basket of securities that trades like a stock. ETFs are like a cross between a mutual fund and a stock because you can diversify and trade them.

- Asset Allocation—the way investors diversify their portfolios and divvy up their investments, primarily between stocks, bonds, and cash.

*Auguste Escoffier School of Culinary Arts does not provide financial advice. Always consult with a professional to determine what is best for your situation.

Managing Your Money in Culinary School

Now that you know some of the basics, it’s time to look at what you might want to consider as you look at your education. Any college student has expenses; culinary school students need to plan for the usual secondary school expenses, as well.

Understand Your Expected Costs

Colleges are obligated to explain your cost of attendance. Here are some categories to keep in mind as you look into culinary school:

- Tuition

- Housing (will you live on-campus or off-campus, or study online from home?)

- Other living expenses like groceries, cell phone, personal care, etc.

- Laptop, internet connection, tools

- Weekly ingredients for assignments

- Commute for externship

A good budget can help you focus on your studies.

Be Smart About Student Loans and Financial Aid

You have a variety of options to help you pay for your culinary school education via student loans, financial aid, work-study programs, and more; we recommend that you get in touch with our financial aid department to help walk you through the steps.

There are many forms of financial aid for culinary school available to those who apply and qualify—and the best way to begin is by completing the Free Application for Federal Student Aid (FAFSA®). You can read through our FAFSA guide to get a general understanding of the FAFSA process for culinary school.

Understanding the types of financial aid and their repayment schedules can be a key component of developing an effective budget and avoiding surprises. It can also be a factor in your job search, as you’ll want to be sure you can cover your monthly expenses, including upcoming or existing loans.

A subsidized loan doesn’t start accruing interest until six months after you either graduate or drop to half-time student status. In other words: it’s time to start paying them. So if you’re graduating in May and job-hunting in the spring, keep an eye on those loans that will start demanding payment in November.

You can set up automatic transfers with your bank to make sure you don’t miss any payments, and send extra anytime you have an opportunity. Student loan debt typically takes around 10 years to pay back, if you borrow under the Federal Stafford Loan program.**

**Financial aid is available for those who apply and quality. International students are not eligible.

8 Common Money Management Terms

As the word “literacy” implies, financial literacy is a lot like learning a new language. And just like studying a new language, an important step is to add vocabulary to your repertoire. Here are some terms to get started with, and then you can gradually work up to more complex ideas.

1. Debt-to-Income Ratio

Your debt-to-income ratio (DTI), which represents the percentage of debt you carry in relation to the income you bring in, is one way lenders judge how responsible you are with your money. The higher the number, the more debt you carry—and the bigger the risk that you might default on making loan payments.

“To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income,” according to the Consumer Financial Protection Bureau. (Gross monthly income is what you earn before taxes and other deductions.)

“The average American spends nearly 10% of their monthly income on debt payments,” says an article in Motley Fool, which reported the debt payment-to-income ratio in the fourth quarter of 2023 at 9.8 percent.

The most common kinds of debt include:

- Secured—a debt backed by collateral, like a home loan or a car loan. If you default, the lender can seize the collateral, i.e. the house or the car.

- Unsecured—a loan that isn’t backed by collateral, like credit cards, medical debt, and student loans. These are considered riskier for the lender, hence they typically have higher interest rates and can sometimes be harder to qualify for.

- Revolving—debt in which you can repeatedly borrow and repay money, aka an open line of credit up to a certain amount. Credit cards are the most common example.

- Installment—when you borrow a fixed amount of money and make payments until the debt is paid off. Student loans fall into this category.

Credit cards are a type of revolving debt, typically an unsecured loan.

2. Annual Percentage Rate

An annual percentage rate, or APR, is the interest rate plus other fees related to a loan; these can include origination and service fees. The APR represents the actual yearly cost of borrowing money.

When you evaluate loans, it’s important to understand the various fees included in the APR. For example, a credit card might charge different interest rates and fees for purchases, cash advances, and balance transfers. Additionally, you’ll often see promotional APRs that entice you to sign up for a credit card at an introductory rate that increases after six months or a year.

3. Asset vs Liability

In the simplest terms, an asset is something that adds value to your bottom line while a liability is something that subtracts from it. Or, as Schwab Moneywise describes them: assets are what you own and liabilities are what you owe.

It can get surprisingly complicated to sort these out for a business, but in your personal finances, it’s typically more straightforward. Cash, stocks and bonds, life insurance policies, jewelry, and the like are assets. Liabilities are things like credit card debt and other loans.

Add up your assets and subtract your liabilities and you come up with your net worth. Your house and your car could wind up on both sides of this equation. For example, if you own a house, the asset value is the market value of the house—what you’d get if you sold it today—while the liability would be to subtract what’s left on your mortgage.

4. Interest Rate

An interest rate is what it costs you to borrow money. Whenever you borrow money, whether a student loan, mortgage, auto loan, or through a credit card, you’re responsible for paying back the principle (the original amount) plus interest.

The lower the interest rate, the less you’ll pay. A variety of factors go into determining the interest rate you’ll pay on a loan, including your credit score and the type of loan you’re taking out. A mortgage, in which your house serves as collateral, will typically have lower interest rates than a credit card, which is an unsecured loan.

Higher interest rates usually mean higher payments, while lower interest rates mean lower payments.

5. Compound Interest

Compound interest typically has to do with the money you earn on your savings and investments, specifically when you earn interest on top of interest.

Say what?

In short, compound interest says if you leave your money alone and continue earning interest, you’ll experience growth that snowballs over time.

Here’s a good example from Investor.gov of the Federal Securities and Exchange Commission:

“… if you have $100 and it earns 5% interest each year, you’ll have $105 at the end of the first year. At the end of the second year, you’ll have $110.25. Not only did you earn $5 on the initial $100 deposit, you also earned $0.25 on the $5 in interest. While 25 cents may not sound like much at first, it adds up over time. Even if you never add another dime to that account, in 10 years you’ll have more than $162 thanks to the power of compound interest, and in 25 years you’ll have almost $340.”

Compound interest is important to understand because it can help you better save for retirement and other long-term savings plans. You’ll be less likely to borrow from your retirement account and other savings if you understand the true cost of doing so—it’ll potentially cost you far more than an early withdrawal penalty (for retirement accounts). The potential interest on the loan will essentially reset because you lower the baseline amount earning interest.

6. Cost of Attendance

When you evaluate schools, it’s important to understand your bottom line—what does it cost when everything is taken into account? That’s what the cost of attendance is.

The Consumer Financial Protection Bureau defines it as, “The total amount it will cost you to go to school — usually stated as a yearly figure. COA includes tuition and fees; room and board (or a housing and food allowance); and allowances for books, supplies, transportation, loan fees, and dependent care if applicable. It also includes some miscellaneous and personal expenses.”

What is the Cost of Attendance?

This breakout comes from Federal Student Aid, a division of the federal Department of Education:

If you’re attending school at least half-time, the COA is the estimate of:*

- Tuition and fees

- Books, course materials, supplies, and equipment;

- Cost of housing and food (or living expenses);

- Transportation expenses;

- Loan fees (excluding any loan fees for non-federal student loans);

- Miscellaneous expenses (including a reasonable amount for the documented cost of a personal computer);

- Allowance for childcare or other dependent care;

- Costs related to a disability;

- Costs of obtaining a license, certification, or a first professional credential; and

- Reasonable costs for eligible study abroad programs.

*Auguste Escoffier School of Culinary Arts does not provide financial advice. Always consult with a professional to determine what is best for your situation.

7. Emergency Fund

An emergency fund represents money you set aside for unexpected expenses and financial emergencies. It’s a cushion you build to protect yourself should you lose your job, have a medical emergency, a major car or house repair, or other unforeseen expenses. An emergency fund helps you avoid dipping into your savings or investments to cover those costs, avoid taking out high-interest loans, and potentially avoid scenarios like declaring bankruptcy.

The rule of thumb is to save three to six months’ worth of your living expenses. If that sounds like a lot, don’t worry; you can chip away at that goal. Even an emergency account with $500 in it can help with any number of surprise expenses.

8. Opportunity Cost

Opportunity cost is a way to calculate the cost of something you skipped out on versus the choice you made. It’s a good concept to know because it keeps you in the habit of using your money intentionally.

For example, if you have an opportunity to work an overtime shift, you might consider the money you’d earn versus some experience you’d miss out on. Which is more important to you?

Or consider how a culinary school student might use $50 on a mediocre meal out versus using that same amount to buy quality ingredients they could use and learn from while cooking at home. There’s no right or wrong here except in how you assign value to the choice.

Money Management Is As Important As Other Skills

A handful of good money management strategies can potentially ease your stress and allow you to better focus on your culinary education. And those good habits can help you search for a job that’s both fulfilling and puts you on solid financial footing. The sooner you become financially literate, the better off you’ll be—but if you haven’t started, it’s not too late.

You might discover that handling financial matters comes easily to you, but there are things that can help along the way if you don’t, like financial aid. Contact us today to find out more about potential financial aid as well as how to apply.**

TO FIND OUT MORE ABOUT MANAGING FINANCES IN CULINARY SCHOOL, CHECK OUT THESE ARTICLES:

- Can You Deduct College Tuition From Taxes?

- 7 Steps to Making a Financial Plan for Culinary School

- How to Save Money: 10 Practical Tips for Students

*Auguste Escoffier School of Culinary Arts does not provide financial advice. Always consult with a professional to determine what is best for your situation.

**Financial aid is available to those who apply and qualify. International students are not eligible.